2024 Tax Brackets Federal Single

2024 Tax Brackets Federal Single. Single filers and married couples filing jointly; See current federal tax brackets and rates based on your income and filing status.

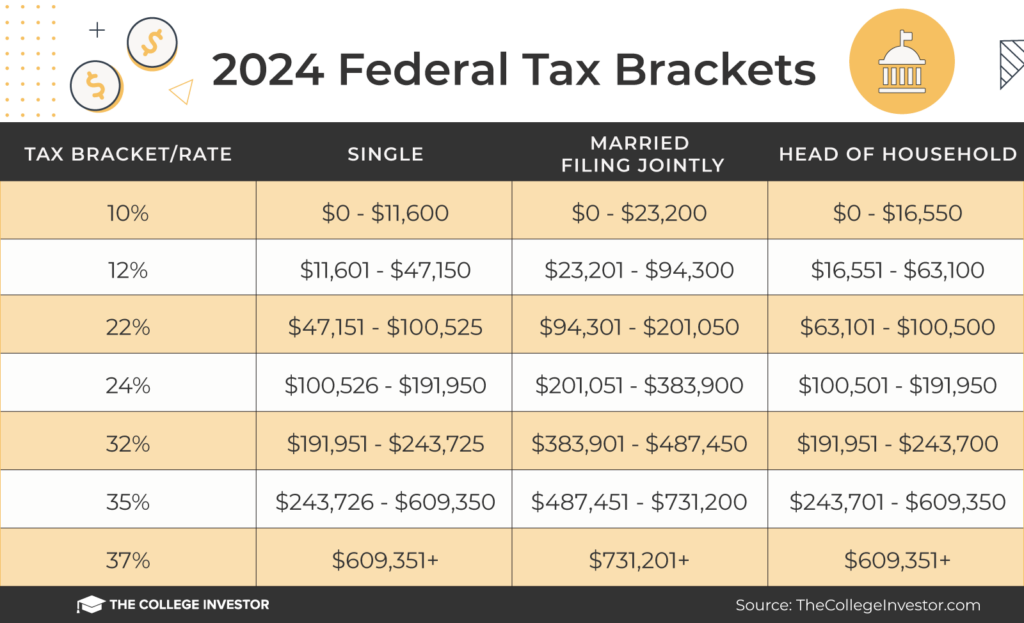

Federal tax brackets for 2024. The seven federal income tax brackets for 2023 and 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. The federal income tax brackets for 2024 are in the tables below.

(1) Net Investment Income, Or (2) Magi In.

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. All features, services, support, prices, offers, terms and conditions are subject to change without notice.

Which Table To Use Depends On Your Likely Filing Status For The 2024 Tax Year.

For tax year 2024, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples.

2024 Tax Brackets Federal Single Images References:

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know RGWM Insights, Federal tax brackets for 2024.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Federal Tax Brackets For 2023 And 2024, There are seven tax brackets for most ordinary income for the 2023 tax year:

Source: www.taxuni.com

Source: www.taxuni.com

Federal Withholding Tables 2024 Federal Tax, Remember, these aren't the amounts you file for your tax return, but rather the amount of tax you're going to pay starting.

Source: www.ntu.org

Source: www.ntu.org

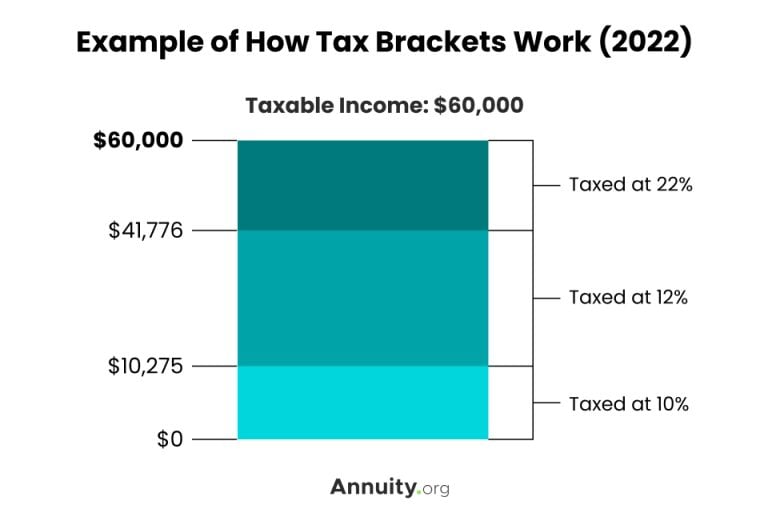

Tax Brackets for 2021 and 2022 Publications National, Federal income tax system is progressive, meaning income is taxed in layers, with a higher tax rate applied to each layer.

Source: greenbayhotelstoday.com

Source: greenbayhotelstoday.com

Tax Brackets for 20232024 & Federal Tax Rates (2023), For individuals, 3.8% tax on the lesser of:

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, In fact, you may be able to tell if you’ll be in a higher tax bracket next year and make some.

Source: www.taxuni.com

Source: www.taxuni.com

Federal Withholding Tables 2024 Federal Tax, Single filers and married couples filing jointly;

Source: boxden.com

Source: boxden.com

Oct 19 IRS Here are the new tax brackets for 2023, Federal tax brackets for 2024.

Source: calendar.cholonautas.edu.pe

Source: calendar.cholonautas.edu.pe

Tax Rates 2023 To 2024 2023 Printable Calendar, It’s never a bad idea to plan ahead, especially when it comes to anything tax related.

Source: vnexplorer.net

Source: vnexplorer.net

New Federal Tax Brackets for 2023, 10%, 12%, 22%, 24%, 32%, 35% and 37%.

For 2024, The Standard Tax Deduction For Single Filers Has Been.

The seven federal income tax brackets for 2023 and 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Federal income tax system is progressive, meaning income is taxed in layers, with a higher tax rate applied to each layer.

Tax Rate Taxable Income (Single) Taxable Income (Married Filing Jointly) 10%:

2022 federal income tax brackets.

Posted in 2024